MDAE believes that the true purpose of education is to liberate the minds of young students. Set-up in 2014, at Mumbai, under the able guidance of Lord Meghnad Desai, Professor Emeritus, London School of Economics, the focus of the academy is to address the yawning gap between what the market needs and what traditional colleges offer. Through an amalgamation of theoretical rigor, interdisciplinary exposure and mentorship, the Academy prepares students for real life, by teaching them how to think and not what to think!

Know More

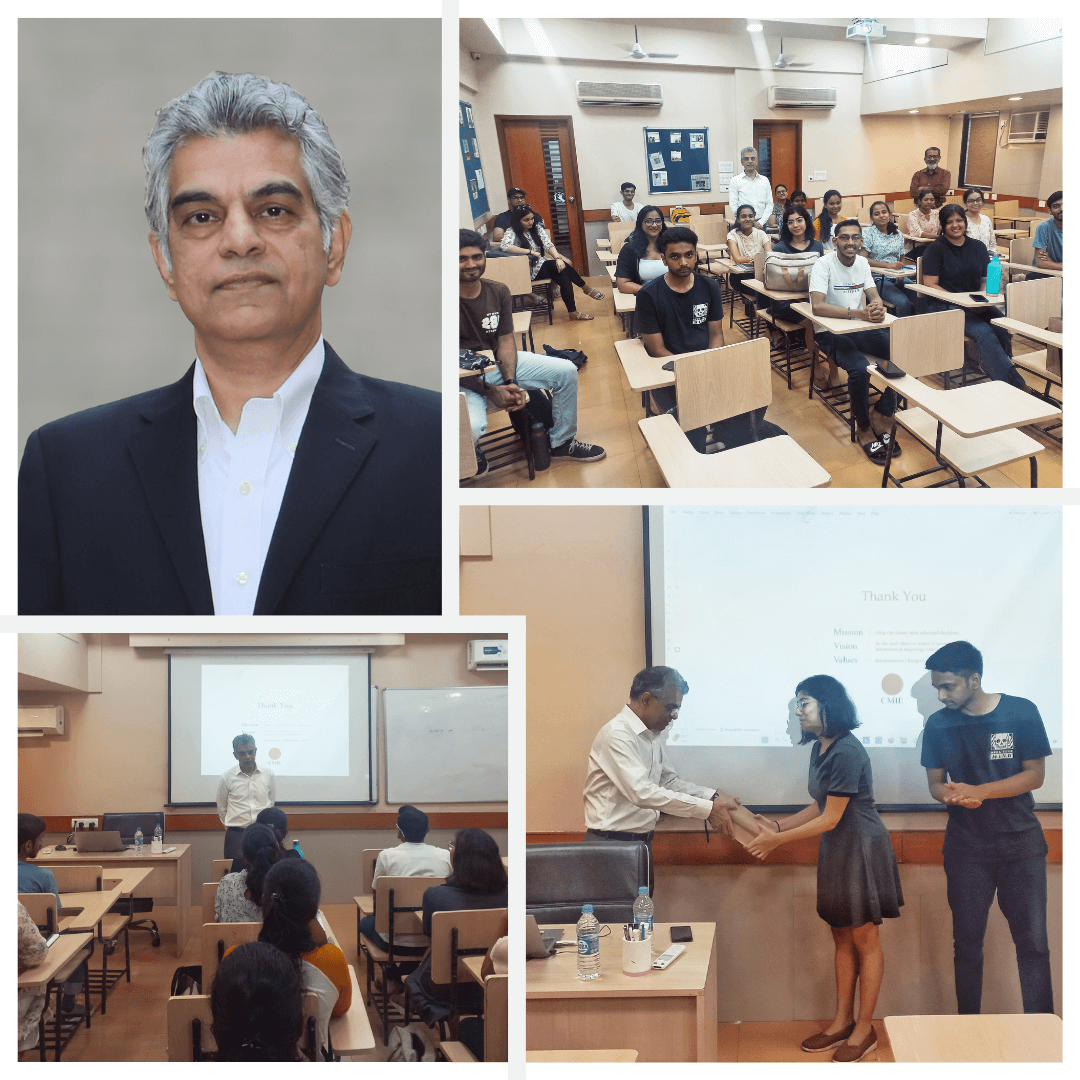

Mr. Mahesh Vyas, MD & CEO-CMIE at MDAE

A decent job is characterised by a written contract, paid leaves, and social security.

CMIE has been recording unemployment data since 2016, revealing a disconnect between growth and employment in India. From 2016 to 2024, labour force participation has declined by 4%, and the employed population has declined by 6%, while the proportion of unemployed population was at a steady state at 8%.

The RBI’s focus on the trade-off between inflation and growth overlooks the crucial trade-off between inflation and unemployment rate.

Entrepreneurship is rising, but we need large-scale entrepreneurs who can provide employment to large populations rather than those disguised in the form of self-employed. Women face systematic disadvantages in employment.

Listed companies should grow their net fixed assets to hire more as Governments and large companies are best suited to provide decent jobs. To sum up, providing poor quality jobs to many, high-paying jobs to a few, and excluding women is not the path to a robust and inclusive recovery.

Minus geopolitical shocks, India’s macroeconomy can handle costlier crud...

An unforgettable image from the last session held in the old Parliament ...

The Meghnad Desai Academy of Economics (MDAE) is pleased to announce tha...

The Meghnad Desai Academy of Economics (MDAE) is pleased to announce tha...